The Overlooked Importance Of Customer Feedback

Why gather customer feedback? The insight gleaned from surveying customers allows you to make better business decisions and identify at risk customers. This can stop reoccurring problems, increase customer satisfaction, and reduce churn. But the benefits of customer surveys, mobile surveys, feedback forms, and social media/website monitoring go beyond that.

Mike Maher, co-founder and CEO of Taylor Stitch and Aura Nelson, senior manager consumer insights for Wolverine Worldwide took time to talk customer feedback with RetailOperationsInsights.com, covering everything from what can be accomplished with customer surveys to the best way to analyze the data they generate to make better customer-informed buying decisions.

Q: What are some overlooked benefits of gathering customer feedback and do consumers fill them out thoughtfully?

Maher: One overlooked benefit is that giving your opinion doesn’t need to be a burden for customers. In fact, our customers are excited to get a preview of the upcoming assortment we're working on and we’ve seen engagement and spend metrics increase significantly. It also pairs nicely with our internal Workshop crowdfunding platform. We also gather internal feedback from our designers, merchants, planners, and marketing teams. It’s definitely interesting to see where our team does and doesn’t align with our customer about which upcoming products are most exciting.

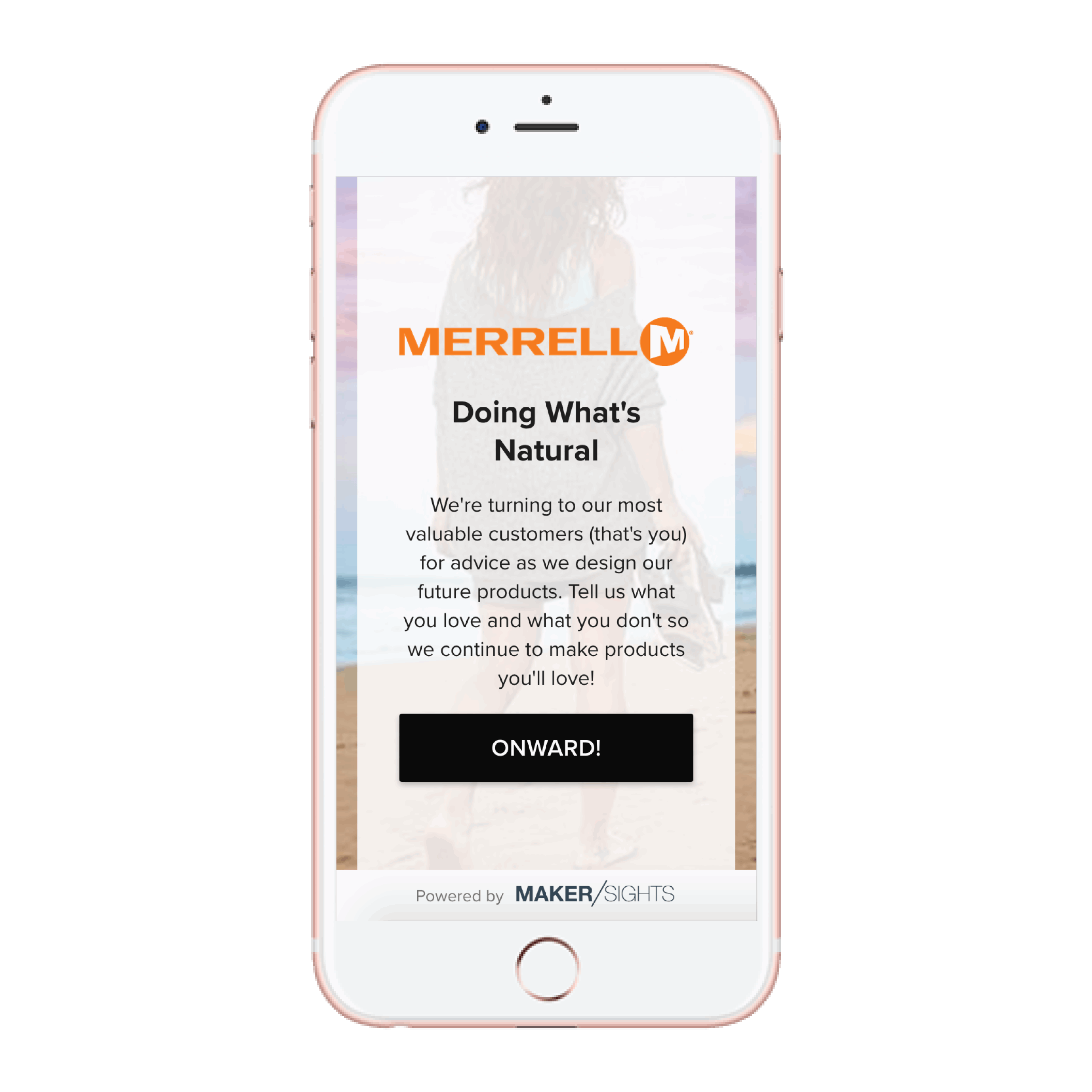

Nelson: Consumers love when our brands reach out to them directly to help them determine what items will “make the cut” for the next season. We often receive comments from grateful consumers who feel their voice is being heard in our decision making. In order to keep them engaged we try to provide a quick and visually appealing experience to make them feel like they are truly helping us refine our product lines and color choices.

Q: Besides familiarity and the chance to ask specific questions, what can be accomplished with customer surveys?

Maher: We invest heavily in high-quality fabrics which tend to have long lead times and can be a costly undertaking for a smaller brand like ours. Data is key to ensuring we are de-risking these fabric investments and spending our working capital in the right places.

Nelson: We try to ensure our surveys are efficient for the consumer, but we also work to provide our brands with rich insights. We incorporate quick questions such as rating likelihood to purchase and factors that drive that decision. Because we want to give the consumer a voice to explain their feedback if they would like, we give an option to type in any additional feedback for context. Our product and marketing teams appreciate this additional layer of insight and because it is optional, it doesn’t delay respondents who are more focused on efficiency.

Q: How important are mobile surveys?

Maher: Mobile-responsiveness is critical in order for customers to give feedback — of the more than 50,000 customers we've collected responses for, almost 70 percent come from customers using their mobile phones. We anticipate this percentage to grow as well.

Q: Does social media have a place in gathering customer insights?

Maher: We haven't dipped our toes in the water here yet, but definitely see this as an opportunity. We are open to experimenting with how we communicate with our customers — including investing behind messaging functionality. We need to be where our customers are; it’s all about them at the end of the day.

Q: Surveys can generate a great deal of data. How do you analyze this data to help make better customer-informed buying decisions?

Maher: Before anything hits the production lines we want to know what our customers think. To date, we’ve dropped 30 percent of the SKUs we’ve tested from our line. Surveys give us the foresight to know those SKUs will be unproductive, just sitting on shelves driving down margin. Instead, we can take the dollars freed up by dropping those SKUs and re-invest them in our winners, ensuring we are protected in the inventory that will move.

Nelson: It's important the output of data is prescriptive to show us how we should allocate an investment across a group of products. From there, we can dig into more information such as how preferences shift for a certain age group or if two products are likely to cannibalize one another because they share the same customer. We love to filter by where consumers prefer to shop for our products so we can bring these insights to the table when we have discussions with our retail partners.

Q: Retailers and brands value customer centricity and faster speed-to-market. How do these customer-insight gathering technologies help deliver those values?

Nelson: We are working as a company to shorten our idea-to-market time and gathering rapid feedback from a tool like MakerSights helps us to expedite our product and marketing decisions and ensure we are moving toward our goal of being a consumer obsessed growth company. It’s important to us that data-driven consumer insights are at the table when key decisions are being made.