Grocers Can Redesign Brick-And-Mortar Retail To Beat Amazon At Its Own Game

By Colin Reid, SAS

Last weekend as I stared at the produce section in my local grocery store thinking about how nice it would be to give my shopping list to someone else to fill so I could enjoy a leisurely cup of coffee and come back later to pick up my order, I was run down by another shopper’s cart. One minute I was examining Honeycrisp apples, the next I was clutching my Achilles tendon. When I turned around, to address the other shopper, I discovered it wasn’t a time-pressed consumer who crashed into me. It was an apologetic Instacart Shopper sprinting around the store trying to do his job. This encounter made me realize the modern grocery store is the nemesis of efficient online shopping.

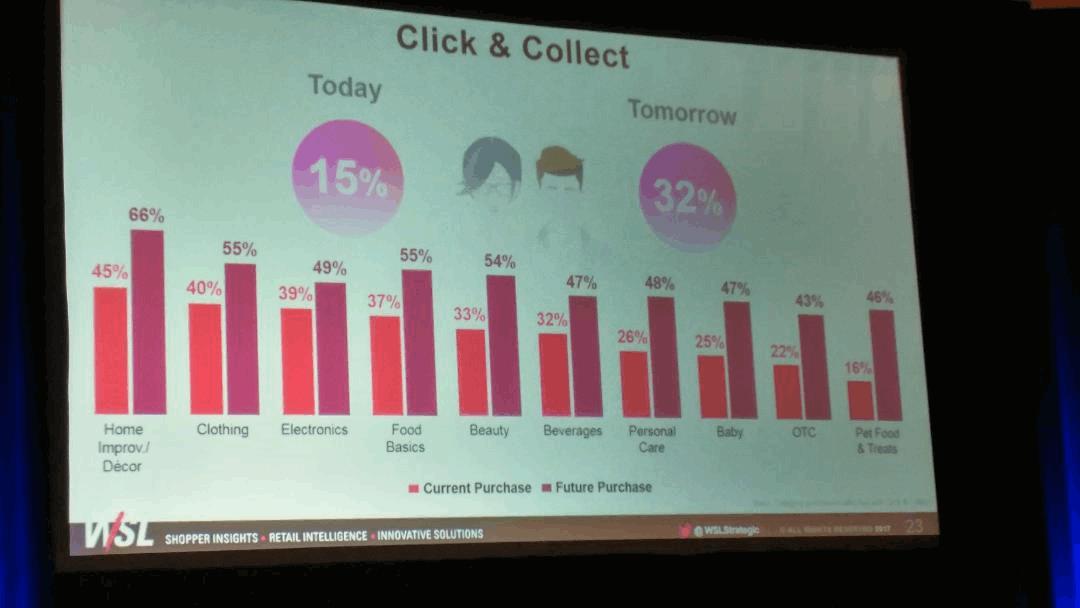

Click and Collect to double in the next 12 months

Grocery stores are designed to make sure shoppers navigate the entire store combining staples such as eggs, cheese and bread with tempting unplanned items to fill the shopping basket. With click and collect shopping predicted to double in the next 12 months, (see Figure 1) grocery stores are creating a dichotomy between enticing discretionary spend from foot traffic and efficiently picking and collating online orders in a timely manner within the same retail location. As click and collect and home delivery become mainstream shopping solutions, this contrast will represent a significant growth hurdle for grocery stores.

Figure 1: Click & Collect Growth 2017-2018[1]

As the grocery industry capitalizes on online ordering, the options are many and the stakes massive. Whether an organization chooses to self-manage home delivery, outsource it to a third party like Shipt or Instacart, promote click and collect or pursue all three strategies, they have advantages over a player like Amazon: deep local market knowledge and proximity.

It’s even more of an advantage if you consider that four out of 10 click-and-collect consumers go into store on the same visit1.

Retailers have worked hard to build stores in the perfect fulfillment locations

Grocery chains spend millions on trade-area analytics to determine the best locations for future stores. They’ve amassed an ocean of loyalty program and transaction data that tells them exactly what shoppers in a specific area buy. When this data is processed with predictive analytics, the insights revealed allow them to efficiently deliver assortment planning, supply chain logistics, pricing and marketing strategies to a micro-district level. Each store carries a near perfect selection for the consumers it serves. Plus, it’s located near consumers so they can easily get to it. But ‘near’ doesn’t always equal ‘easy’ in this environment.

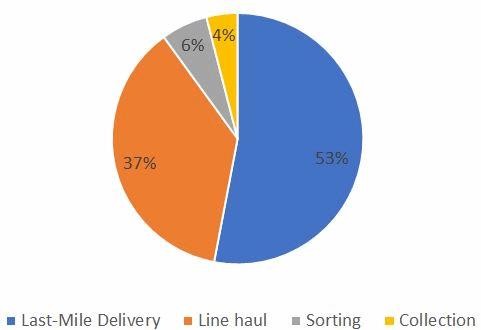

Amazon now has a warehouse or delivery station within 20 miles of 44 percent of the US population[2]. But juxtapose that with the fact that a grocery store has almost 100 percent of its population within a 4-mile drive of its target market. Four miles is significantly different than 20 miles. When you consider how this difference affects delivery - the biggest single cost with fulfilling digital shopping - it’s easy to see how grocery stores have the competitive advantage.

Figure 2: Share of Delivery Cost[3]

It’s such an advantage that getting a local market footprint from which to expand was one of the major factors behind Amazon’s acquisition of Whole Foods. Amazon is still digesting its Whole Foods acquisition. To date, they haven’t been able to capture new consumers from outside the traditional store catchment areas[4]. When they’re ready, they’ll strike at the heart of the US grocery business. So now is the time for local grocers to build their own online market because of their location advantage.

A hybrid dark and retail store

As same-store sales decline grocers can compress or close areas of their stores to create a dark store. A dark store is one designed specifically for order pickers, not consumers. Amazon designs warehouses for picking. The company’s automated warehouses are designed for speed and efficiency and have delivered some impressive results so far:

- “Click to ship” cycle time [which ranged from 60 to 75 minutes] fell to 15 minutes[5]

- Inventory capacity increased by 50%5

- Operating costs fell an estimated 20%5

Can a grocer replicate Amazon’s success without AI and robotics?

Grocers already possess the most important ingredient for succeeding in the in-store and online shopping environment: data. Grocers own unique intellectual property, and they can seize the opportunity to create an effective dark store area within each retail location. Even without expensive artificial intelligence investments, they can scale click and collect or home delivery as needed. If properly leveraged with analytics, grocers can deploy their localized knowledge to create unique layouts for each dark store location to reduce fulfilment times and operating expenditures and drive improved volume and profit. Some initial steps along this journey include:

- Leverage data. Because grocers own an ocean of unique transaction data, they can leverage it with analytics. For example, they can associate items commonly purchased together – like butter and eggs - in that specific store, and position them next to each other in a dedicated picking area for online orders. Analytics can help create the most efficient dark store layout on an individual basis.

- Prepare for dark store success. Grocers can fit more items on shelves for pickers than in-store retail shelves as they don’t need to neatly space items or have boxes facing forward. This means the dark area can be relatively small but will generate a higher yield per square foot. Concerning store logistics, an individual grocery store can also optimize access points to support the differing needs of delivery drivers, click-and-collect shoppers and traditional in-store foot traffic. Being sensitive to these differences eliminates front-of-house congestion.

- Don’t neglect the consumer experience. As grocers position for these new opportunities don’t forget consumers choose and shop with a brand because they have positive interactions that generate trust and loyalty. As click and collect and home delivery explode, don’t neglect the brilliant basics. The opportunity to surprise and delight consumers in store with expert advice and new selections will drive more frequent visits, high- value baskets and help grow all channels.

It takes a bold organization to use analytics to deliver these changes and own the local market before Amazon leverages its new reach, but it can be done. To quote NYU Stern Professor of Marketing, Scott Galloway from his excellent new book, The Four:

“Stores are here to stay, if we are careful what stores we’re talking about. But so is e-commerce. Ultimately, the real winners will be those retailers who understand how to integrate both.”[6]

See also: https://www.linkedin.com/pulse/us-grocers-reacting-fast-enough-amazon-whole-foods-colin-reid/.

[1] Source: Wendy Leiberman, CEO WSL Strategic Retail at Consumer Goods Sales and Marketing Summit, NYC June 5th, 2017

[2] Business Insider September 8, 2016: http://www.businessinsider.com/amazon-replace-trips-to-stores-2016-9

[3] Source: Honeywell Business intelligence 2016

[4] Source: https://www.linkedin.com/pulse/us-grocers-reacting-fast-enough-amazon-whole-foods-colin-reid/.

[5] McKinsey’s State of Machine Learning And AI, 2017 by Louis Columbus on July 31, 2017

[6] The Four by Scott Galloway, published Portfolio / Penguin 2017