How Technology Helps Retailers Dominate Their Markets As Shoppers Return

By Holly Worst, Worldpay from FIS

During the pandemic, global brick-and-mortar retailers that relied on in-store traffic saw their volume of point of sale (POS) transactions plummet as a result of forced shutdowns and closures.

It was no surprise then that POS sales fell sharply around the world, as customers stuck at home turned to home delivery, curbside pick-up, and, most frequently, online shopping. Retailers equipped with the technologies to support these functions were well-positioned for the accelerated shift toward a more digital marketplace.

But now, as the pandemic’s effects recede to endemic status, people are once again driving to stores, browsing isles, feeling materials, seeing products for themselves, and talking to people face-to-face.

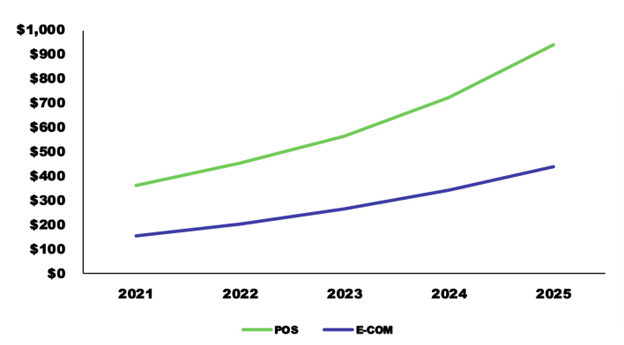

The 2022 Global Payments Report from FIS found the POS market rebounded strongly from the impact of COVID-19, growing 13.4% in 2021 and surpassing 2019’s market size much sooner than expected. And in 2021, total retail sales were up almost 18%, four points higher than the 14% increase in e-commerce, according to the U.S. Department of Commerce. Sales continued to soar early in 2022, with the retail sector in January growing 3.8% over the prior month.

But the retail industry is far from back to “normal”. Store owners continue to struggle with staffing and supply chain shortages, and customers are quick to return to digital shopping when in-store experiences fall short. People are now also accustomed to the convenience of buying from the comfort of home – from groceries to makeup to furniture.

So, what can in-store retailers do to keep up with new demands? Those who adopt technology that enables convenient, seamless experiences will be better placed for growth — keeping consumers coming back for more.

The Future Of Retails Starts With Seamless Payments

As people turned to digital alternatives to pay for goods and services, COVID-19 accelerated the pace of cash’s decline.

Around the world, cash has fallen to historically low usage, representing only 11.4% of POS transaction volume in the U.S., 5.7% in Canada, and less than 10% in others, including Australia and Sweden.

As the use of cash dwindles, mobile wallets have taken over point of sale and e-commerce transactions. Mobile wallets are now the leading POS payment method globally, accounting for 28.6% of global POS transaction volume – more than $13.3 trillion.

More companies are also beginning to realize customers’ needs for flexible payment options. For example, global retail titans like IKEA are now taking advantage of “embedded finance” capabilities by letting customers settle transactions seamlessly through their own website or app — services that were once only controlled by financial institutions and banks.

Retailers are also offering buy now pay later (BNPL) services, which allow customers to do just that — buy something when they need it and pay for it over time. This feature is so popular that global BNPL transaction value across e-commerce and POS is expected to grow to $1.3 trillion by 2025.

As more tech-enabled payment innovations continue to increase in popularity, forward-looking retailers may wish to consider adopting these trends to keep up with demand.

Where Worlds Collide: How In-Person Retail Enhances Online Shopping

Many retailers also understand that the future of brick-and-mortar success may come from mixing the in-person experience with the conveniences of online shopping.

For instance, after taking a hit during the pandemic, fashion and clothing chain Zara wanted to make a change to the in-store experience to not only make up for lost revenue but to adapt to the post-pandemic shopping era. They understood some consumers might still be wary of crowded stores and long lines for fitting rooms. Zara’s parent company, Inditex, invested $3 billion to upgrade shopping experiences, which included digital app upgrades.

The app now allows shoppers to browse outfits at specific stores and reserve changing rooms online in advance of visiting the stores. Shoppers also can view an integrated store map to see exactly where clothes are in the stores and even check themselves out. As a result, Zara’s parent company saw sales return to pre-pandemic levels by mid-2021, far ahead of its less tech-savvy peers.

Cosmetics company L’Oréal had a similar realization when their popular in-person experiences — such as trying on lipstick or foundation samples — were removed for public hygiene concerns. But L’Oréal was already experimenting with augmented reality before the pandemic struck. The company bought the beauty platform ModiFace in 2018, which enables customers to try on multiple types of makeup and colors virtually. That effort expanded during the pandemic, providing a virtual makeup-counter experience through social media platforms such as Facebook and Instagram.

What’s Next In Self-Checkout

Retail giant Amazon continues to innovate in customer experience design, integrating its online and brick-and-mortar stores, carving out its reputation as an early leader with its “smart” grocery stores in 2020.

In this model, a proprietary “Dash Cart” allows you to scan items as you choose them and monitor the total cost of your groceries in real-time on a small screen. When you’re ready to check out, you can drive your cart through a designated lane, and a sensor automatically reads your data and applies appropriate charges to your Amazon account or debit card. For customers, Amazon’s Dash Cart eliminates the hassle of waiting in a checkout queue, driving faster transactions, with convenience placed as a top priority.

Technology Empowers Retailers And Keeps Customers Happy And Loyal

Brands are embracing technology and data to serve in-person customers more effectively.

While not all retailers may be able – or want – to invest at the same level as Amazon, there are ways retailers can incorporate online data-driven insights and customized tools to enhance the customer experience.

Retailers may wish to consider the following innovations and ideas:

- Allow customers to check in or scan a QR code upon entering the store. This will provide insights into how often they shop with you, what they buy, and when they buy it.

- Check-in services also will allow you to offer coupons for items your customers often purchase, which may help persuade them to visit your store over competitors.

- Replace checkout lanes to make every POS terminal flexible for self-checkout or assisted checkout.

- Provide easy, convenient payment methods, such as pay via digital wallets or QR codes.

- Add “buy now pay later” services to increase sales by allowing customers to pay over time.

Embrace A Seamless Future With The Right Financial Technology Advisor And Partner

Retail industry leaders are looking for ways to leverage sweeping changes to the way people shop and pay. In this new environment, pioneers in online and in-person shopping integrations, automated checkout, and seamless customer experiences will win.

To implement these cutting-edge strategies, you’ll need a partner who understands your business. FIS can help you accept smarter, more innovative payments and improve the retail experience through enhanced checkout options, loyalty coupons, and data insights.

About The Author

Holly Worst is Senior Director of Vertical Growth for Retail at Worldpay from FIS.