Mobile Point-Of-Sale Shipments Surge By 50 Percent In 2013, But Many Devices Go Unused

Merchants’ desire to conduct customer transactions on tablets and smartphones spurred a more than 50 percent boom in shipments of mobile point of sale (mPOS) hardware in 2013. But does the fact that more than 1 million of these devices were inactive last year, indicate issues in real market adoption?

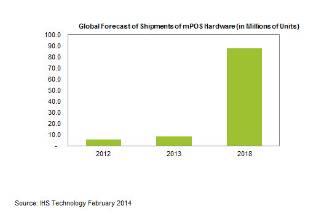

Global shipments of mPOS hardware devices soared to 8.4 million units in 2013, up 53 percent from 5.5 million in 2012, according to IHS Technology (NYSE: IHS). The attached figure presents global mPOS device shipments in 2012 and 2013, based on data from the new report entitled “Mobile Point-of-Sale (mPOS) – World – 2014”.

But despite the massive growth, only 7.1 million of these devices were active in 2013, meaning that 1.3 million mPOS systems went unused during the year.

“Retailers increasingly are embracing tablet- and smartphone-based systems to check out customers, providing an alternative to the cash registers used by large- and medium-sized merchants, or the informal systems—such as cigar boxes—employed by the smallest businesses,” said Wincey Tang, digital ID & IT security analyst at IHS. “The wide availability and low-cost advantages of mPOS card-reader accessories make them a feasible payment acceptance solution for any business owner.”

For the mPOS dongles not being used on a regular basis or were completely inactive, these could be traced to a specific segment of users.

“While the inactivity and low usage may raise questions about the continued expansion of the mPOS market, the phenomenon appears to be concentrated among micro-merchants,” Tang said. “As larger enterprises start completing mPOS trials and move onto full rollouts in the coming years, this will drive larger sales volumes. Because of this, IHS predicts global mPOS device shipments will rise to nearly 88 million in 2018, more than 10 times the total in 2013.”

Mobile POS devices come in various solution types, including dongles/pure swipers, sleeves and integrated solutions.

Dongles are attachments that plug into a mobile device and allow credit cards to be swiped. Sleeves typically encase the mobile device that is being used as the interface to conduct transactions. Integrated solutions include any purpose-built, all-in-one devices, according to IHS.

Dongles are inexpensive and make mPOS solutions easy to implement, requiring a very low level of commitment from adopters. This has driven early acceptance, particularly among micro-merchants that are not concerned about attaining large volumes of transactions or achieving a high return on investment. Many micro-merchants that have adopted mPOS also conduct most of their transactions in cash, so it’s not surprising that they do not make much use of the credit-card-based mPOS devices they have obtained.

Dongles were the largest single segment of the mPOS device market in 2013.

Rather than dongles, larger institutions for their part prefer sleeves and integrated solutions that can work with their existing enterprise resource planning (ERP) systems. Because of this, sleeves and integrated solutions will outpace dongles in shipment growth during the next five years.

Even so, other elements must be developed before the market reaches this stage.

“When we look at how many pieces there are in the entire payment ecosystem, mPOS is just one relatively small, component,” Tang said. “And that component is highly dependent on developments in a multitude of aspects, from Near Field Communication (NFC) to contactless payment, to the Europay-MasterCard-Visa (EMV) standard. And that’s not even including anything on a consumer level.”

Complexities and challenges also arise from having to manage the changes to customer interactions and purchasing experiences that come about as a result of introducing mPOS technology.

About IHS

IHS is the leading source of information, insight and analytics in critical areas that shape today's business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs approximately 8,000 people in 31 countries around the world. For more information, visit www.ihs.com.

Source: IHS