New Research: Small Brands Scale And Disrupt Using Two Key Strategies

By Angela Fernandez, GS1 US

A line of organic body lotion. A personalized baby onesie. A hand-knit hat. Any of these items seen online or in a store could be the brainchild of a motivated small business owner, fulfilling a life-long dream of bringing their own products to the masses.

There’s no question that small brands are disrupting the retail landscape, taking advantage of the new opportunities available through e-commerce with unprecedented force. In fact, since 2013, more than $17 billion of consumer goods sales have shifted from large players to small brands, according to IRI. These small, nimble companies have caused many established brands to rethink how they approach the consumer, and they have caught the attention of retailers who seen an opportunity to wow consumers by bolstering their product offerings with unique finds.

However innovative they may be, it remains a major challenge for small brands to break through and achieve success. According to the new research report “Charting the Growth Journey: From Product to Profitable Business” from GS1 US, the most effective strategies to scale profitably are twofold: mastering a strong and diverse channel mix, and compiling and maintaining clear and consistent product information. Small brands that deliver on both are positioned to move beyond the daily struggles of being a startup and scale the business to the next level.

Mastering A Diverse Channel Mix

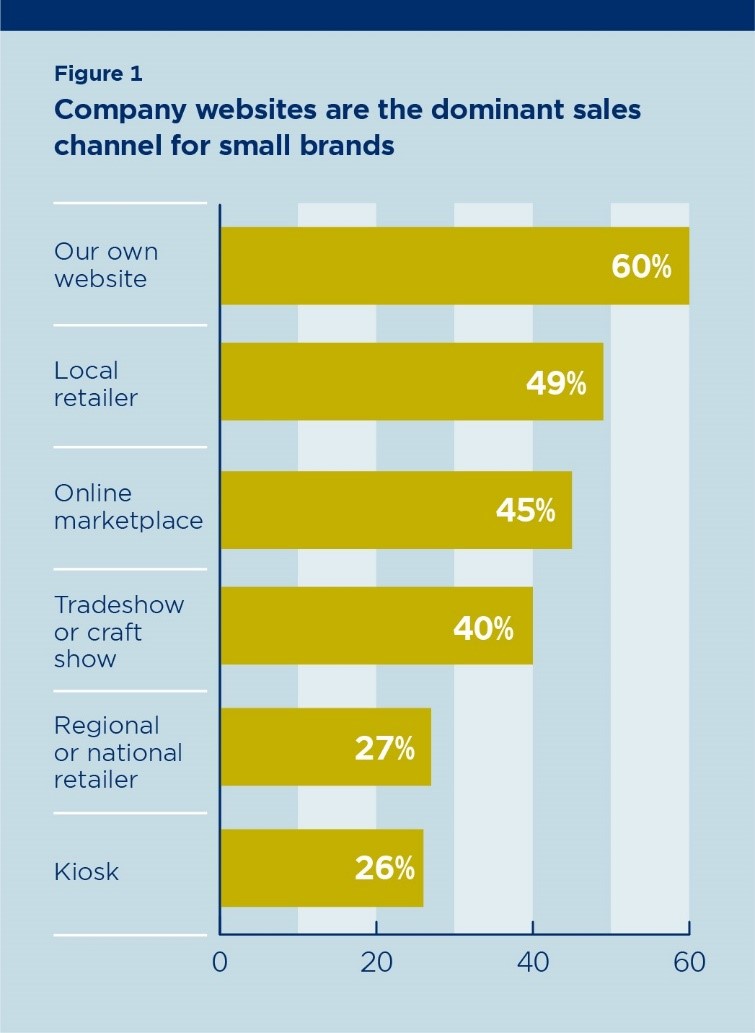

The GS1 US study, conducted in collaboration with Longitude this past spring, surveyed 513 owners or directors of small brands. For the majority of small businesses surveyed (60 percent), their own website is one of the most significant channels to enable sales, which suggests they prefer to maintain closer marketing relationships with customers. However, brick and mortar still matters--the study found that local retailers are the second most important sales channel for small brands and ranked them closely to online marketplaces as a key sales channel (Figure 1).

The GS1 US study, conducted in collaboration with Longitude this past spring, surveyed 513 owners or directors of small brands. For the majority of small businesses surveyed (60 percent), their own website is one of the most significant channels to enable sales, which suggests they prefer to maintain closer marketing relationships with customers. However, brick and mortar still matters--the study found that local retailers are the second most important sales channel for small brands and ranked them closely to online marketplaces as a key sales channel (Figure 1).

Allison White is the founder of Scout Cart, a personal utility cart brand she runs out of her home and sells through multiple sales channels. “Once we set up our website, we sold 200 carts right away, without any advertising or anything else,” she said. “They were our early adopters. Then we started selling through a major online marketplace and that really helped us gain exposure. Once you get on to the e-commerce sites, it can open doors to selling through other retailers.”

To clearly decipher which strategies work the best to help small businesses grow, the data was examined in the context of two groups--Leaders, the brands that reported more than 25 percent revenue growth over the past year, and Laggards, brands that reported a revenue decline over the past year.

The research found that focusing on a single channel can be detrimental to revenue growth (Figure 2). Only one-third (34 percent) of growth laggards say partnering with a new retailer or online marketplace is a top priority over the next 12 months. For this group, the average number of channels they currently sell through is just 1.3; for growth leaders the number rises to 3.1.

Online marketplaces are also an essential channel, with revenue on these platforms expected to more than double to $40.1 billion globally by 2022, according to another study by Juniper Research. These marketplaces not only expose small brands to potentially millions of new customers, they ease the burden of back-end operations such as billing, fulfillment, and returns. The survey supports the importance of this channel: 97 percent of those using an online marketplace such as Amazon or eBay have recorded revenue growth in the past 12 months.

Product Information Drives Revenue Growth

A critical element for selling products through any channel is making sure that complete and accurate product information is available to retailers and consumers. This enhances customer trust in products and in the brand itself. Consistent product information makes products easier to find and buy – 59 percent of high-growth small brands see a correlation between completeness of product information and sales of those products.

“The name of the game is having a digital presence and reaching as many customers as possible with as much information as possible that helps people understand your product. In a noisy world, you often need to decode a product. One of the biggest problems for entrepreneurs is that they don't take the time to help create that understanding,” said Joanne Domeniconi, cofounder of The Grommet.

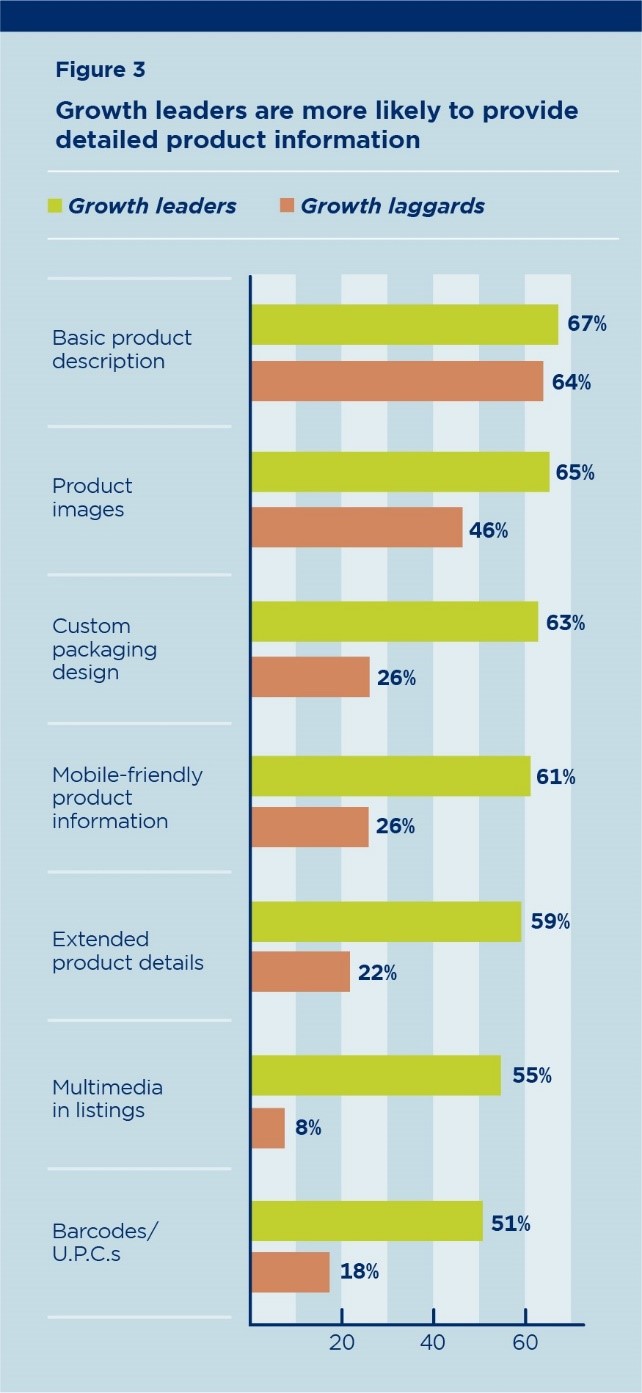

Growth leaders recognize the value of providing more than just basic product information and are investing accordingly. They’re much more likely to include product images, and more than twice as likely as lagging brands to include extended details (such as the product’s country of origin or whether the product is machine washable) and to make sure the information is mobile friendly (Figure 3).

What’s holding the laggards back? More than half say preparing products for sale via external channels is burdensome and 48 percent have not developed a long-term sales strategy.

What’s holding the laggards back? More than half say preparing products for sale via external channels is burdensome and 48 percent have not developed a long-term sales strategy.

By comparison, leading companies are almost three times more likely to identify their products with Universal Product Codes (UPCs) than declining brands. Few of this lower performing group recognize the value of UPCs for their business, which suggests they’re overlooking the potential that product information has in taking their business to the next level.

“A unique identifier like a UPC helps in earning trust with the consumer because they are getting all the correct information and know that it’s a legitimate product,” says Kait Flynn, former senior vendor manager at Amazon, who was interviewed as part of the study.

“The UPC ties to the supplier and the item number we provide it,” says Vanessa Siahmakoun, director of supplier development at Walmart. “Everything has a touch point and is connected. It’s important to have your best game before you get in front of a merchant because, hopefully, you can just ship it and get it right to the shelf.”

Whether your brand is large or small, the retail industry is growing more competitive by the day. Maintaining a clear, long-term sales strategy that includes diverse channels and an abundance of product information is critical to win the loyalty of today’s consumers. For more information on the GS1 US research, visit www.gs1us.org/small-business .

About The Author:

Angela Fernandez is the Vice President of Community Engagement at GS1 US, where she oversees programs designed to support growth for companies of all sizes. With more than 20 years of retail supply chain experience, she is an expert in helping companies understand retailer requirements and achieve source to store supply chain visibility.