Now Is The Time For Retailers And Fashion Brands To Embrace Digital Strategies To Balance Resilience, Scalability And Efficiency

By Bryan Nella, Senior Director, Supply Chain at Infor

According to UBS, 100,000 retail stores could close over the next five years, a total that is triple the amount closed during the 2007-2009 recession. In parallel, the study forecasts e-commerce reaching 25 percent growth rates for U.S. retail sales. UBS also predicts that online grocery sales will rise from 3 percent this year to 25 percent by 2025.

For retailers and brands, now is a time to re-examine business models and supply chains to meet demand into the future while balancing newfound challenges and priorities. E-commerce and direct-to-consumer distribution initiatives are essential for survival. But finding other innovative ways to engage customers while balancing cost and risk is a must. Starbucks, for example, has launched an initiative to shift toward pick-up only locations in dense cities such as New York, Chicago, and Seattle.

Growing Pains

Amazon remains a leader in e-commerce. eMarketer estimates that it will own 38 percent of e-commerce market share in 2020, up slightly from 37.3 percent in 2019. But even Amazon has had its challenges of balancing growth, inventory, service, and costs. According to RBC, 64 percent of Amazon customers indicated they were very or extremely satisfied in May 2020, compared to 73 percent the prior year. The decrease is due to prevalent stockouts and delays in recent months. But the trend goes back further, indicating that in the past five years, customer satisfaction has declined from 87 percent in 2015. All of this continues despite excessive hiring throughout its network to meet demand. Adding headcount to keep up with volume surges is common practice in the industry well beyond Amazon.

The U.S. Bureau of Labor reported that delivery companies added 12,100 jobs in May 2020, the third straight month of job expansion. However, the Wall Street Journal reports that as a result, FedEx and UPS are adding surcharges to shipments to offset rising costs from the surge in volumes. A continuous cycle continues to play out as companies try to balance scalability, efficiency, and resilience.

Balancing The Big 3

A “trinity” of supply chain and organizational strategies focused on resilience, scalability, and efficiency has emerged at the forefront of recent recovery playbooks. However, inserting buffer inventory to ensure resilience, or adding headcount to support scalability or relying on just-in-time efficiency are not viable long-term practices. In fact, these tactics come at the expense of other primary objectives.

While many retailers and brands have had to sacrifice some organizational strategies over others, a limited few have been able to successfully navigate with the three goals in lockstep. Retailers and brands that had digital strategies in place, or that were quick to deploy digital strategies, were better positioned to excel as the economy was upended. But it’s the digital underpinnings that connect retailers, brands, their internal teams, and external partners that separate the industry leaders from the rest of the pack.

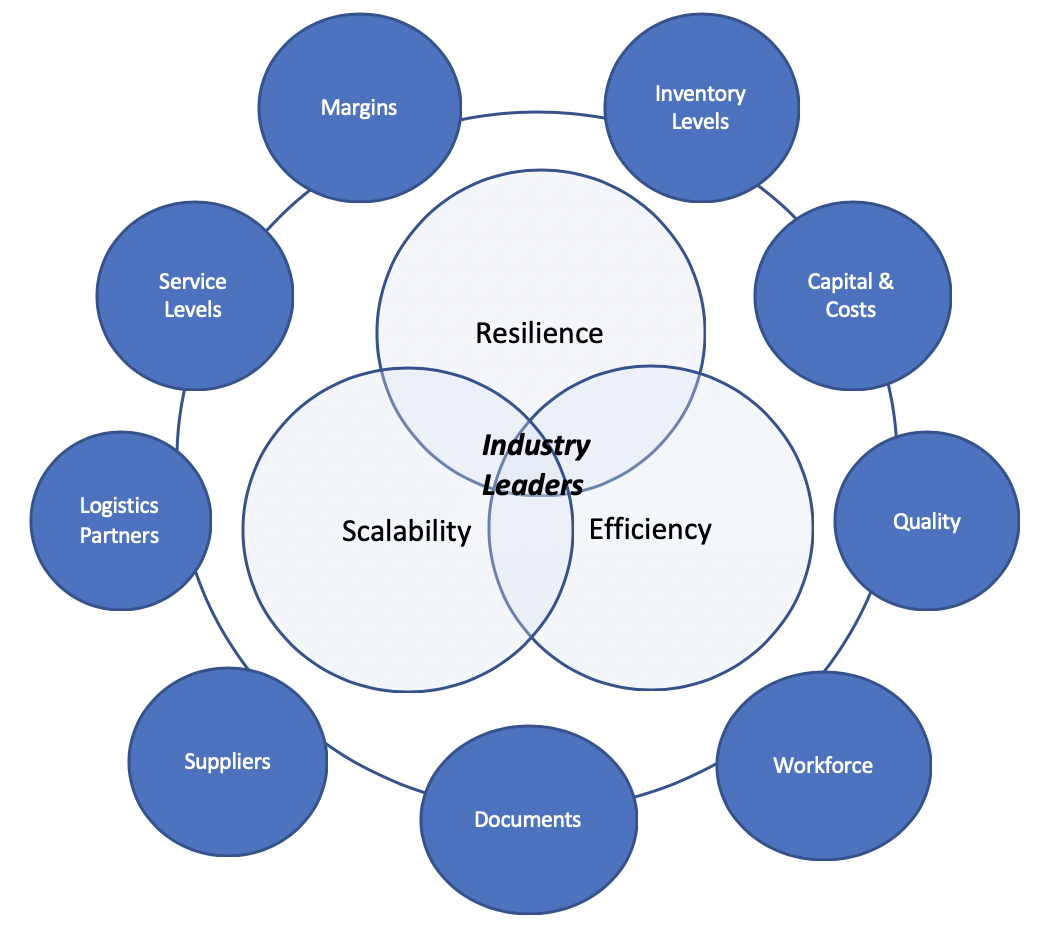

In the figure below, the trinity goals of resilience, scalability, and efficiency are all potentially conflicting and overlapping. Retailers and brands that operate within closed-off silos or rely on manual processes tend to find themselves experiencing conflict when addressing more than one of these goals. For example, I add new employees to my warehouse or to accounts payable to meet demand, but my costs rise and margins erode. Or I reduce inventory levels but, as a result, my service levels drop.

Several interdependent supply chain variables would be impacted and would need to be considered when finding the right balance of organizational strategies to focus on. Organizations and supply chains that seek to thrive in the coming years have a heavy and complex task ahead, where all these interdependent factors cause unintended consequences that can hinder other priorities.

Companies that can optimally harmonize and balance scalability, resilience, and efficiency will derive competitive advantages in the industry. The connections and plumbing that make information accessible, shareable, and actionable is core to the business and everyone that relies on it within the enterprise and the supply chain.

Working within a digital ecosystem, companies and their supply chain partners can automate processes, increase worker productivity, and reduce costs where it is obvious. Simultaneously, they benefit from connectivity and agility to make changes and adapt as disruptions occur, without the need to buffer or add costly mitigation measures.

A networked multi-enterprise approach is essential to supporting long-term viability and growth. Connecting all internal teams, as well as suppliers, third-party logistics providers (3PLs), finance providers and customs on one digital platform breaks down silos and fosters innovation. It allows data to be unlocked for the entire supply chain. A digital representation of the supply chain provides the foundation and levels to achieve several key goals.

- Process automation drives out costs and improves efficiencies while equipping the business to scale rapidly.

- Digitally connecting supply chain partners eliminates data silos, errors, and process inefficiencies. However, it also delivers agility to react to market shifts and rapidly execute.

- The marriage of physical and financial supply chain flows enables the injection of capital at multiple milestones of the supply chain, mitigating the supplier-related financial risk and simultaneously improving supplier health, equipping them to better support retailers’ and brands’ growth.

Digitizing the way retailers, brands, and their supply chains connect, collaborate, and execute decisions is the first step on the road to recovery. Those that move quickly toward a digital strategy will be better equipped during times of contraction and growth.