360pi Data Shows Best Price Is Not The Lowest Price For Retailers; Improved Price Competitiveness Of Walmart, Target And Macy's Not Correlated To Improved Financials

Macy’s enters “race to the bottom” in household category, misses Q2 expectations; Kohl’s consistently prices above Amazon in households, reports healthy financials

In an age of increased price transparency, it is critical for retailers to be price competitive. However, at the same time they must avoid the proverbial “race to the bottom” in pricing – a point that is underscored by the recent performances of several top-tier retailers in a key category.

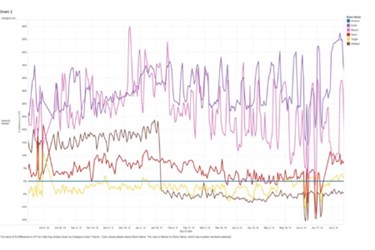

360pi’s pricing analysis of 1000+ household goods based on Amazon’s own assortment relative to Kohl’s, Walmart, Target and Macy’s provides an excellent example. As reported by 360pi between March-June 2014:

- Kohl’s was consistently 30-60% above Amazon’s pricing for this sample, but also reported the healthiest financials of the group.

- In the same category and timeframe, Macy’s was consistently 20-40% above Amazon until April 2014, then appears to have been drawn into the “price wars” with Target, Walmart and Amazon – which likely contributed to missed Q2 expectations.

- Walmart has consistently been underpricing Amazon in this category since mid- January 2014. Together, Target and Walmart have closed the pricing gap with Amazon to within a 5% range in July, compared to a 30% spread last fall. At the same time, however, Walmart and Target have both experienced under-performing sales and financial losses, while Amazon is under mounting pressure to improve profitability.

“We found this particular analysis fascinating because it puts a very large mirror on the pricing strategy that so many retailers fall prey to—the race to the bottom in which no one wins the gold medal,” said Jenn Markey, vice president of marketing, 360pi. “This holiday season will be a test to see which retailers will get it right by being responsive to the competition rather than reactive, and leverage a combination of loyalty programs with personalized offers and a unique assortment to deliver on the brand promise conveyed to their target shoppers.”

These retail trends were presented in a recent webinar from 360pi and Retail Systems Research analyzing leading retailers’ latest pricing strategies. The webinar is available on demand here. (http://discover.360pi.com/acton/fs/blocks/showLandingPage/a/9666/p/p-0081/t/page/fm/0?utm_medium=email&utm_source=ActOn+Software&utm_content=email&utm_campaign=360pi%20webcast%20recording%20available&utm_term=watch%20it%20on-demand%20at%20any%20time.&cm_mmc=Act-On%20Software-_-email-_-360pi%20webcast%20recording%20available-_-watch%20it%20on-demand%20at%20any%20time)

About 360pi

360pi derives profitable insights from product and pricing big data to help leading omnichannel retailers, etailers, and manufacturers compete and win in a price transparent world. 360pi's customer base accounts for over $US100 billion in annual retail sales and includes Ace Hardware, Build.com, Overstock.com, and RIS Fusion award-winner Best Buy Canada. 360pi monitors millions of products with unprecedented accuracy to give retailers and manufacturers real-time visibility into the market with full awareness of the competitive pricing landscape to "right price" for their respective customers. Ultimately, 360pi helps customers make smarter pricing decisions to drive increased revenues and margins.

Source: 360pi