Self-Checkout Terminals To Quadruple By 2014

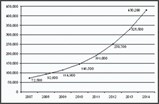

According to the findings of a new study carried out by Retail Banking Research the number of self checkout terminals (SCOs) had reached 92,600 by the end of 2008. The study, which was carried out in the first half of 2009, and which comprised extensive primary and secondary research, showed that the number of SCOs installed around the world had increased by more than a quarter since the end of 2007. Moreover, RBR forecasts that by the end of 2014, the number of SCO terminals installed around the world will have more than quadrupled to number 430,000.

There is a fundamental difference between SCO terminals and regular assisted point-of-sale terminals: SCO terminals allow customers to handle the payment and/or bagging/scanning components of the checkout process themselves, instead of being served by a member of staff.

This technology was introduced over two decades ago but it only began to gain in popularity relatively recently. The last decade has seen the retail industry, and in particular outlets such as supermarkets, hypermarkets and convenience stores, embrace the ethos of self service at the point-of-sale. Many of the world's top retailers, including Wal-Mart, Carrefour and Tesco, are rolling out SCOs in selected countries. Despite the recent progress, SCO remains a niche product in all but a handful of countries, and it still has a long way to go to reach the level of penetration achieved by traditional assisted point-of-sale terminals.

The number of SCO units installed worldwide increased 28% to 92,600 in 2008. North America dominates the SCO market in terms of installed base, the 74,000 units installed there at the end of 2008 representing 80% of the global total. Western Europe was home to 15,000 machines and Asia Pacific 3,000 while the other regions contained no more than 700 machines between them. RBR's research also revealed that in 2008, a total of 22,800 global SCO shipments were made, up 19% on the year before.

RBR forecasts that the SCO installed base will more than quadruple in size to reach 430,000 by 2014. North America will still account for more than half of this figure, with Western Europe representing 32% and Asia Pacific 13% of SCO installations. The adoption of SCO technology in the other regions is expected to remain significantly lower, with these regions together forecast to account for fewer than 4% of terminals.

There are some compelling business reasons for deploying SCOs. They are said to be more cost-effective because one attendant can supervise four or more such terminals so employees can be redeployed to improve service elsewhere. In addition, SCOs more than double the number of points of sale that can be made available to customers in the same space as regular EPOS terminals. Moreover, SCOs are becoming increasingly popular with customers because they give the illusion of faster service – an experience which one leading supplier calls "wait warping". Customers also feel more in control in that they can be sure that all discounts are being correctly registered. SCOs also give customers a sense of privacy.

It is for reasons such as these that the world market for SCO terminals is growing so healthily and why some of the world's leading retailers are installing them in ever increasing numbers.

SCOs are particularly popular in North America where growth in the installed base is forecast at 20% per year over the next six years. Some of the larger North American retailers are installing SCOs in greater numbers than previously, and this has increased forecasts for SCOs in the region. The drivers for SCO deployment in Western Europe are similar. Both regions have relatively high labour costs – not a coincidence as deployment of SCOs therefore leads to greater cost savings in these regions.

In markets with lower labour costs, the business case is weaker. Brazil, for example, contains only a handful of SCO installations, and those that are deployed are hardly used at all. The unions are strong and highly regarded in Brazil, and they have greatly publicised their opinion that retailers use SCOs to replace the human workforce. SCOs are therefore unpopular because they are said to constitute a threat to the workforce.

Another potentially huge market is Japan. Whilst it is one of the world's largest markets for assisted EPOS terminals, it is still a relatively small market in terms of SCOs. In Japan there is a widely held view that SCO terminals reduce the level of service, which makes them difficult to sell in a country where a high level of service is seen as paramount. The situation is gradually changing, however.

RBR's research also showed that NCR, Fujitsu, IBM and Wincor Nixdorf are the world's leading SCO manufacturers, both in terms of the number of shipments they delivered in 2008 and the size of their installed bases at the end of that year. These four vendors account for 99% of the world's SCO market.

"Global EPOS and Self-Checkout 2009" summarises the key findings from extensive primary and secondary research on the world market for Retail Automation which RBR conducted during the first half of 2009. It describes the current market for Programmable EPOS and SCO in terms of units shipped and installed and end-users' expenditure, and provides vendor shares in terms of units shipped. The report also provides forecasts up to 2014.

About Retail Banking Research

Retail Banking Research is a strategic research and consulting firm with three decades of experience. It specialises in the areas of cards, payments and automation in the banking, retail and hospitality sectors. Based in London, RBR serves clients across more than 100 countries worldwide through premium research reports, consulting, newsletters and conferences.

For more information, visit www.rbrlondon.com/retail.

SOURCE: Retail Banking Research